The smart Trick of social security number (ssn) That Nobody is Discussing

During the pandemic section, you stated “There isn't any other way to get an EIN for non-US residents, so be sure to Wait and see.” Do you suggest that non-US citizens should NOT send out mail/fax to IRS for EIN all through this time? I’m a non-US resident but I have a US handle with a company Found inside the US.

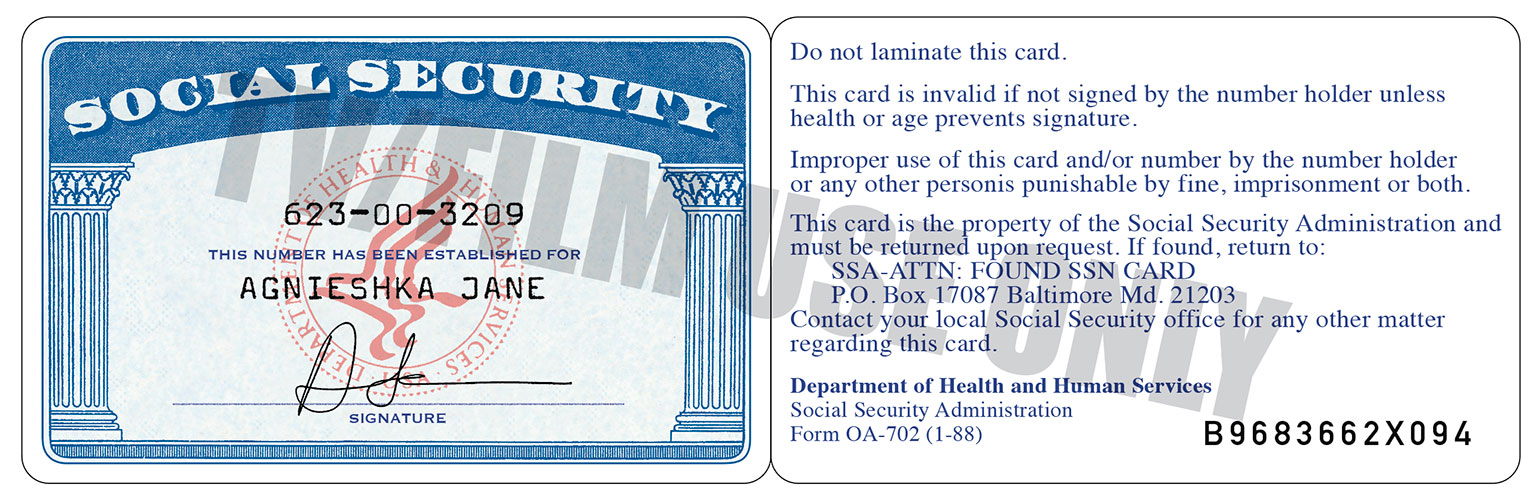

Exacerbating the condition of using the Social Security number being an identifier is the fact that the Social Security card has no biometric identifiers of any form, making it primarily unachievable to inform no matter whether an individual making use of a particular SSN genuinely belongs to another person without the need of depending on other documentation (which can by itself are falsely procured as a result of use from the fraudulent SSN).

Rocky, you should just hold out a little bit. I sent it on November 2nd and obtained a reply with EIN on January 21st

You are certainly welcome Yado! The IRS is de facto backed up. The present condition is including significant delays… and December and January also are really occupied months. Remember to see Oleksii’s reply beneath. It’s definitely greatest to only wait around and Wait and see. Sending in a number of SS-4s is not really a good idea. It could cause difficulties. In all of my encounter with the IRS, the IRS doesn’t miss documents or reduce items. It just normally takes for a longer social security card online services period than anticipated often. And what’s going on today on the planet hasn't occurred just before.

For those who have short term permission to live and function in America, you can find a Social Security card stamped “valid for get the job done only with DHS authorization."

The modifications will simplify your indicator-in encounter and align with federal authentication specifications. Concurrently, we’re continuing to supply Risk-free and protected entry to our online services.

I am a Nigerian presently in Virginia and I am wondering if I may get ein number by filling the SS4 form or not

We suggest that you've a conversation using an accountant in advance of selecting check here real new social-security-card-online-ssn how your foreign-owned LLC are going to be taxed.

I have applied for an EIN by way of fax as being a non resident alien. I sent it in early December 2020 but full documents website didn't gained any reaction still. Is usually that normal? Does one imagine that I ought to I resend the SS-four towards the IRS?

As Portion of the online application, you’ll really need to enter facts from a U.S. driver’s license and your relationship certification.

Site two is just an informational web page and you also don’t really need to submit it on the IRS. Although, should you take place to mail in Web page 2, don’t get worried, the IRS will just toss it absent.

Profit enhance. The meant SSA agent phone calls bearing good news — say, an increase in your Rewards. To get the extra cash, you merely really have to fork out a fee or confirm your identify, date of delivery and Social Security number.

It will also provde the day of beginning (DOB) of the person related to the social security number, but only if it is on file

Hi Katie, usually you may publish a letter for the IRS explaining the problem and demonstrating evidence of the proper. However, we only concentrate on LLCs, so I’m unsure I’m answering your dilemma as best I could.